The government recently announced changes to the probate fees coming into effect from May 2017 onwards. Although opposed by a vast number of people, the change, and increase, in fees will help ensure the UK court system as a whole covers its costs according to the government.

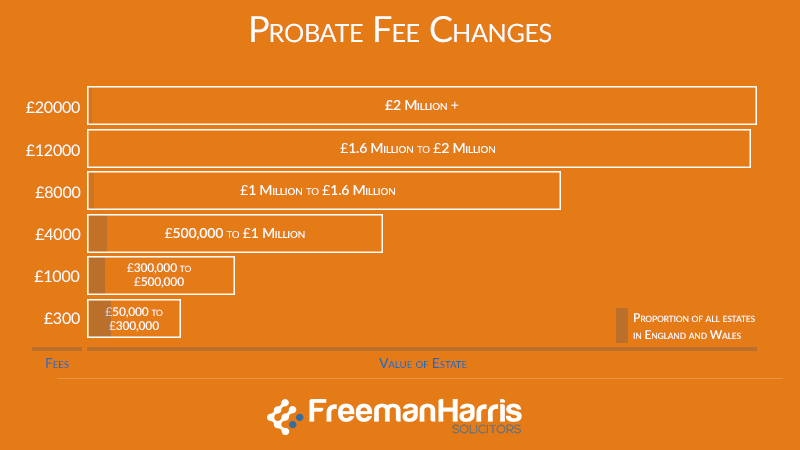

The new fee structure for probate applications can be seen as follows:

The fee is based on the net value of the estate passing under the grant of probate. The date of the application for a grant will dictate if the new fees will apply, and the Probate Registry is expecting an increase in applications prior to May 2017.

When a person passes away, a grant of probate has to be applied for especially if the deceased held valuable assets. A large number of estates involve applying for a grant due to the size of their estate. This is used to manage the deceased pensions, ISAs and transfer land/property to an heir. Financial institutions and land registry want to see a grant to complete such requests.

Are there any methods of managing higher probate fees?

Married couples can own assets jointly so when the death of one spouse occurs, the surviving spouse will inherit the assets automatically. This will remove the need to apply for a grant, however, this might not work for everyone. If the deceased intended to pass the estate on to another person apart from their spouse, then it would only be possible through a grant.

In some cases, the individuals might try to make lifetime gifts to their heirs in order to lower the value of their estate. If the probate fees are based on the net value of the estate, this could be a method of bypassing higher fees, but it would result in an higher Inheritance Tax charge. Joint ownership between the individual and the heir can be complicated process, which should not be followed by most individuals.

The change to the fees is being berated as another example of ‘death tax’ in the press. The increase in the amount of costs after you have passed away isn’t a great thought, which is why it’s important to get the relevant legal advice at the right time so that you know what will be owed and how to manage it.